What is an IEO (Initial Exchange Offering)?

You probably already know an ICO, but an IEO is a relatively new concept. An IEO is a new form of crowdfunding by blockchain start-ups and stands for Initial Exchange Offering. You can compare an IEO with an ICO but completely run through a cryptocurrency exchange. At the moment there is a huge hype around IEOs and the demand for ICOs is decreasing. The decreasing trend is not so bad either, because there were a lot of ICOs with failing projects or teams that disappeared after collecting the money.

The benefits of IEOs

Initial Exchange Offerings are run by the largest exchanges today, including Binance. In general, an IEO is equal to an ICO; you can buy a certain number of tokens at a fixed price and there is a maximum set. A big advantage is that the major exchanges put their good reputation at stake to collaborate with a particular project. If it turns out in retrospect that the project was a scam or can’t deliver the promises, then the investors will turn against the exchange.

As a result, the exchanges are more or less forced to select only good projects and do very good research. An exchange only has to deal with one wrong project and there is a big chance that the whole community will turn against this exchange. Because of this, you know (almost) for sure that if you participate with an IEO via Binance, for example, the project is reliable, and thus it is a lot safer to invest via an IEO.

You can also be sure that they will not run off with your investment. Of course, this does not mean that all IEO’s through Binance, for example, will work out well and that the price will rise. It is always important that you do good research into the project yourself.

The token is instant marketable, and the project has less promotional costs

Another advantage of an IEO is that the token is immediately available for trading. After all, the token distribution and sale is done via an exchange, and practice shows that the token becomes available for trading within a week. With ICO’s this can sometimes take up to months. And there are even a lot of cases where the token didn’t even get to an exchange.

The exchange also promotes the project, so that the new project can quickly be shown to a large number of users. This will not only increase the volume after launch but will also make a huge difference to the costs of the new start-up.

Also, as a use you only have to perform a KYC once. After that you can invest in all the IEOs that the exchange launches.

What are the disadvantages of IEOs?

Although the IEO is done via an exchange, it is not 100% guaranteed that the tokens will increase in price. This has been the case in the past token sales, but IEOs will also come to an end after some time. Just like with an ICO. It is also possible that the project does not succeed and is not able to keep its promises for whatever reason.

You are still taking a risk and your capital is at risk!

The differences between an IEO and an ICO

- With an IEO you use the familiar platform of the exchange and not an unknown website of the start-up.

- Investing, lottery tickets, token distribution and listing are handled by the exchange, and not by the start-up itself. This way you know for sure that you receive the tokens and that they are tradable within a short time. With an ICO this can take months.

- The risk of a scam is low because the reputation of the exchange is at stake. At an ICO, the project can close the website after collecting the money.

- With an IEO, the new project uses the client base of the exchange, with an ICO it is necessary to invest in promotion. This saves the project marketing costs and can be invested in the development of the project.

- KYC is handled once by the exchange, at an ICO you have to send your data for each new project.

Do you also want to participate in an IEO?

The best known IEOs are currently arranged through Binance Launchpad. Here are some requirements for investors. For example, you have to perform a KYC and you have to verify your ID with Binance. This process takes no longer than 5 minutes. On top of that you must hold at least 100 Binance Coins (BNB) and have them in your account for at least the last 20 days. This means that you currently need to have at least $ 2200 in BNB in your account.

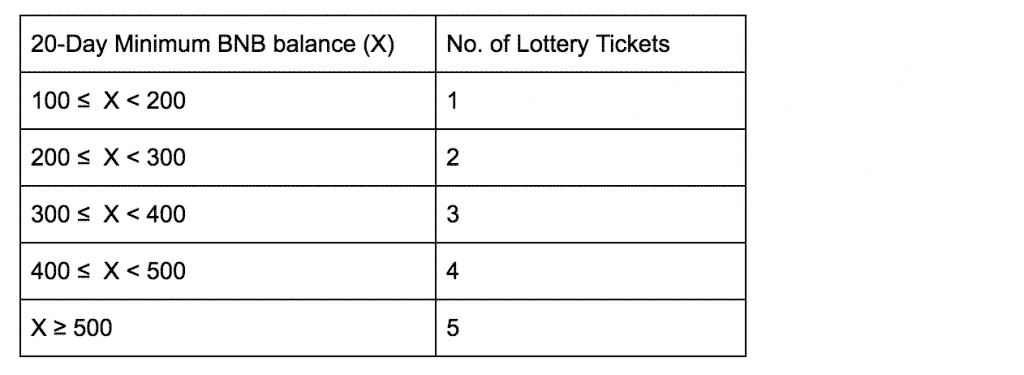

Depending on how much BNB you hold, you can claim Binance lottery tickets with a maximum of 5. On the day before the token sale, you can check whether you have one or more winning lottery tickets. Please note that if you have won you will automatically invest the amount for each lottery ticket.

Examples of Initial Exchange Offerings

- BitTorrent (BTT) – IEO price: $ 0.00012 ROI: USD: 15.42x (1442.2%), BTC: 10.41x (941.2%), ETH: 10.03x (903.0%).

- Fetch.AI – IEO price: $ 0.0867 ROI: USD: 5.49x (449.5%), BTC: 5.42x (441.8%)

- Celer – IEO price: $ 0.0067 ROI: USD: 5.45x (444.6%)

- Matic – IEO price: $ 0.00263 ROI: USD: 17.19x (1618.9%), BTC: 11.42x (1042.3%)

- Harmony – IEO price: $ 0.003175 ROI: USD: 9.59x (859.3%)

These prices are not up to date, but they do give an insight into what the IEO price was and how much return was achieved at the moment of writing this article.

Navigation