What is Bitcoin?

When you hear people talk about cryptocurrency or when cryptocurrency is on the news, it is likely about Bitcoin. For a lot of people, Bitcoin and cryptocurrency are the same, but Bitcoin is a cryptocurrency and there are a lot more other digital coins, called altcoins (alternative coins). Still, Bitcoin is the most famous one, because it was the first cryptocurrency that entered the market. The coin caused a revolution within the economy and is up to this day very popular. Maybe you want to buy Bitcoin in the future, but you do not know what Bitcoin means and how it works. In this article we will tell you everything you need to know about Bitcoin.

The origin of Bitcoin

Bitcoin was launched the third of January around 19:15 (GMT +1). The inventor of the Bitcoin is Satoshi Nakamoto. To this day we still do not know who this person is. A lot of people think it is an alias for a group of developers, but already multiple persons have claimed to be Satoshi Nakamoto. So, the real inventor of the Bitcoin will probably remain unknown for a little longer.

Bitcoin was launched the third of January around 19:15 (GMT +1). The inventor of the Bitcoin is Satoshi Nakamoto. To this day we still do not know who this person is. A lot of people think it is an alias for a group of developers, but already multiple persons have claimed to be Satoshi Nakamoto. So, the real inventor of the Bitcoin will probably remain unknown for a little longer.

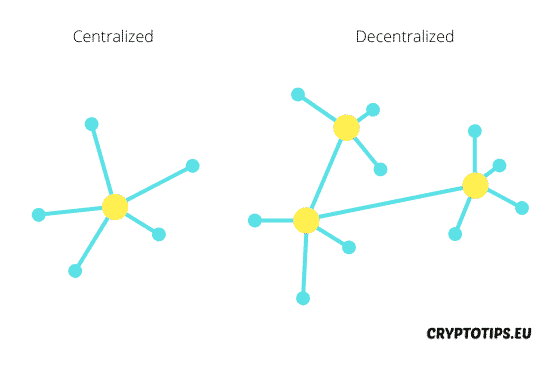

Bitcoin was invented with an obvious purpose, namely creating a decentralized payment method. Decentralized means that no central bank or other entity plays a role within the network. Especially in the run-up to the launch of Bitcoin this was an important point, because the trust in banks reached a low point after the bank crisis in 2009. That is why developers were looking for an alternative. This became the Bitcoin.

On the image on the right you can have a clear view on how a centralized system works with only 1 ruler. With a decentralized system everybody can participate in the network.

Is Bitcoin a payment method just like the euro?

For most people, Bitcoin sounds pretty complicated and they see it more or less as an investment instead of a real currency. Still, you can use Bitcoin the same way you use the euro as a payment method. Although you cannot use Bitcoin to pay of your groceries (yet), but you can transfer Bitcoin to each other. There are even a few web shops that accept Bitcoin. For example takeaway.com, where you can already buy pizza with Bitcoin.

So, you can pay and transfer money with Bitcoin, but where do you keep these digital coins? You cannot simply take out some Bitcoin out of your wallet. You do have your Bitcoin in your wallet, just not physically. When you possess Bitcoin, you need a digital wallet. Where you can store and manage your Bitcoin. This wallet is in most cases located somewhere online, but it can also be stored in an app or a special USB-stick (hardware wallet). From this wallet you can transfer money to other wallets. Transferring Bitcoin is almost the same as transferring money with your current bank. Instead of filling in someone else’s account number, you fill in the address of their wallet. This for example is the address of a wallet: 1D8ho3GBqYGAxMv3c9cm85cQL4FmrPis6G and here you can see all the transactions of the address. Just like all other Bitcoin addresses. Please keep in mind that a Bitcoin transaction is irreversible.

No central bank, but very reliable checks

No central bank also means that there is no central entity performing audits on transactions. The audits within the network are being done by the users themselves. To perform these checks, people have invented the blockchain technology. Blockchain is inseparably connected with Bitcoin. Besides the revolutionary coin, blockchain also attracted a lot of attention.

All transactions done with Bitcoin are stored on the blockchain. You could compare the blockchain with a big ledger. Everyone can use this ledger, which means the Bitcoin system is very transparent. Bitcoin is not anonymous, but pseudo-anonymous. If you know who is behind a certain address you can view all their transactions.

Every 10 minutes all transactions get bundled into one block and are added to the blockchain. So, as the name suggests, it is a long chain of blocks. Since everyone can use the blockchain, users can mutually compare blockchain copies. If everything adds up, the transactions match, but if there is a difference, the blockchain will notice. This means it is a simple but very effective system to discover and counter fraudulent transactions.

The blockchain also contributes to the security of the system. If you would like to know more about the blockchain system, you can check out our website where you will find an extensive explanation about the blockchain. You will, for example, read that blockchain is not only used for cryptocurrency, but is also used for other purposes.

Why is it difficult for people to understand Bitcoin?

The problem is that most people in general do not really know how money works. Money is a system that is used to trade funds. Most people are not into the digital aspect of Bitcoin and do not like the fact that Bitcoin are just ones and zeros. But that is exactly what money is, information. Money is used to provide credible information about a good that has not yet been received.

The problem is that most people in general do not really know how money works. Money is a system that is used to trade funds. Most people are not into the digital aspect of Bitcoin and do not like the fact that Bitcoin are just ones and zeros. But that is exactly what money is, information. Money is used to provide credible information about a good that has not yet been received.

Money cannot be compared with a general ledger with fiat currencies like the dollar or euro. The general ledger is being managed centrally, which gives the owner of the general ledger a lot of power. History shows that this power is often abused. In Bitcoin the general ledger is decentralized, so no one is really in control of the network. This means that no individual or entity can apply influence on the general ledger. Therefore, no one can create inflation, block accounts or freeze/stop transactions.

A form of decentralized money is gold. No one can create extra gold and gold is also divided over the world. However, it is hard to distribute, especially in big amounts. It is not only too heavy, it is also dangerous. That is the reason gold is not suited for worldwide transactions.

This is exactly why Bitcoin is important and revolutionary. It is the first digital currency that is both digital and decentralized. Besides, it is easier to transport than gold and we all know there can be a maximum of 21 million BTC in the circulation. While the total amount of gold can still increase due to mining from rocks. Bitcoin does not look at borders and is way more efficient than traditional banking. This is the reason why people are excited about Bitcoin, because it has the potential to bring a revolution.

Investing in Bitcoin

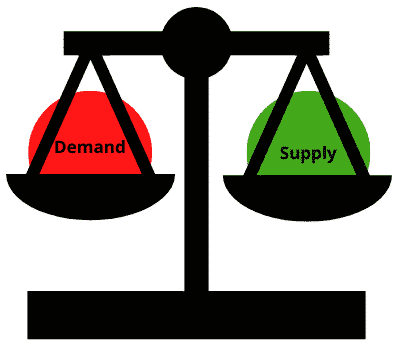

We have already talked about Bitcoin as a payment method. Bitcoin really wants to be that. A future without intervention of banks is the main target of Bitcoin. Still, a lot of people do not use Bitcoin as a payment method, but more as an investment. Since there is supply and demand around Bitcoin, the digital coin has value. These values are also the numbers you hear on the news. One day Bitcoin is worth so many euros, the next day it is a lot higher or lower. Bitcoin is scarce and has a maximum amount of 21 million Bitcoin. At the moment there are almost 18.5 million Bitcoin in circulation. The last Bitcoin is expected to be mined in the year 2140. This means that in 2040 all 21 million Bitcoin will be in circulation. Of all the Bitcoin in circulation, 4-5 million BTC are lost. The reasons for this can be because people lost private keys, lost their wallet, forgot their password or the BTC has been transferred to a wrong account. You are your own bank, remember?

New Bitcoin are coming to the market as a result of cryptocurrency mining

New Bitcoins arise as a result of cryptocurrency mining. When a miner adds a block to the blockchain, he or she will be rewarded with new Bitcoins. This sounds easy, but the adding of a block to the blockchain requires a lot of hash power. That is why miners invest loads of money in upgrading their mining devices. With an average laptop you will not be able to find a block. If you would like to know how the mining of Bitcoin exactly works, you can take a look on our website. At the moment, new Bitcoins are added every 10 minutes, but when there are no new Bitcoins being created the demand will increase rapidly and the value can skyrocket.

You could act on this demand by buying Bitcoin. Via multiple brokers you can exchange euros against Bitcoin. You can save this Bitcoin for a short or long time to sell it afterwards. Hopefully at a higher price of course. On our Buy Bitcoin page you will find all Bitcoin brokers where you can buy Bitcoin with easy payment methods, like creditcard, SOFORT, MyBank, iDEAL and many more. We already talked about Bitcoin as a payment method, with the example of Takeaway.com. In 2013 the first Bitcoin transaction was made for chicken nuggets. Back then this costed 0.079 BTC, which was roughly worth € 13,50. 4 years later the same amount of Bitcoin was worth around € 900. You could say these were very expensive chicken nuggets. Investing is never without any risk. So, keep educating yourself and compare different brokers. That is why we recommend you to read multiple reviews on our website.

Is Bitcoin anonymous?

Bitcoin offers a strong anonymity, but the transactions made are completely visible for everyone. When making a transaction you do not have to know the recipient and you also do not have to give your name, as is required with a regular bank transfer. In that regard, you can transfer Bitcoin to a random Bitcoin address anonymously without knowing who is behind that address. The transaction itself is fully visible for everyone. Every transaction is being registered and you can view all transactions when you have a Bitcoin address.

It is possible to use multiple addresses and never conduct a transaction with the same wallet, but even then, your track can be traced down completely to your first transaction. You can use Bitcoin anonymously if you have a smart approach and acquired Bitcoin through an untraceable way.

How is the Bitcoin price determined?

The Bitcoin price is determined by the supply and demand of Bitcoin. When more people are interested in buying Bitcoin and fewer people want to sell Bitcoin, the demand will increase, and the supply will decrease. If a lot of people decide to sell their Bitcoin the supply will increase on the market and the demand decreases. So, the price is determined by people who are interested in Bitcoin, the owners of Bitcoin and the trading itself.

The Bitcoin price is determined by the supply and demand of Bitcoin. When more people are interested in buying Bitcoin and fewer people want to sell Bitcoin, the demand will increase, and the supply will decrease. If a lot of people decide to sell their Bitcoin the supply will increase on the market and the demand decreases. So, the price is determined by people who are interested in Bitcoin, the owners of Bitcoin and the trading itself.

If the price increases strongly more people are inclined to buy extra Bitcoin, because they expect to make profit in the future. Because of this phenomenon, the value will increase even more and we see that this happens quite often. In contradiction to when the price sharply decreases, where people are afraid of losing too much money and therefore decide to sell their Bitcoins. This amplifies the already ongoing decrease and is also called panic selling.

Nowadays there is a lot of automatic trading with trading bots. These bots will place orders automatically based on the current market movement. They can anticipate really fast without any emotional factors, that is why trading bots also have an influence on the price.

That is why supply and demand cause tremendous ups and downs, but luckily the Bitcoin has never crashed so hard that it lost its value. The more popular BTC gets, the more people will get in touch with it, which will result in an increase of its value.

Navigation