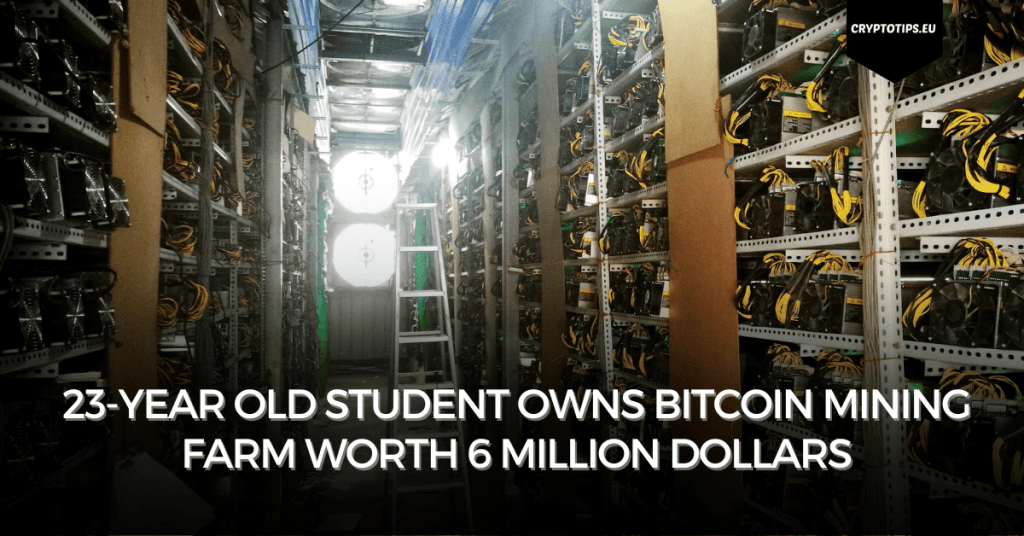

23-year old student owns Bitcoin mining farm worth 6 million dollars

Last Updated on 26 December 2023 by CryptoTips.eu

With the halving only four months out and an expectation that Bitcoin (and other major cryptocurrencies) will also have a very good 2024, the focus is shifting again to the Bitcoin mining companies. In order to maintain their market share, these firms must reinvest their profits to purchase newer and more efficient equipment.

Meanwhile, in a small town in Texas, locals recently discovered that the local Bitcoin mine is owned by a Chinese student from New York.

The 23-year-old bought the mine at the end of 2021 via a payment in Tether. Due to the rising price of Bitcoin, the value of his investment has increased considerably.

Market share

The previous Bitcoin halving took place in May 2020, at the beginning of the Covid-19 pandemic. In the two months before the halving, the price went up 60%, and in the 18 months afterward it went up as much as 600%.

Similar scenes were seen during the halvings of 2016 and 2012. So… you kinda know why Wall Street decided to jump in now.

According to the Financial Times, Bitcoin mining companies have already spent around $600 million on new equipment to prepare for the halving in 2024. The companies doing this are counting on their competitors to be left behind with older equipment, allowing them to move faster. Bitcoin can be mined and thus gain more market share.

CleanSpark, a Bitcoin mining company from Nevada that is listed on the American stock exchanges, has already bought around $280 million worth of such new material. Matthew Schultz, chairman of the company, explained that he is willing to make a smaller financial profit this year in order to gain a larger market share in the coming years.

“It won’t be dissimilar to when China banned mining [in 2021], everybody unplugged, and the percentage rewards skyrocketed for the miners that were still standing,” said Matthew

“The companies that have made these investments [in new equipment] are likely the ones that survive,”

Jerry

Channing is a village of a mere 281 souls in the US state of Texas. The village is located in the middle of a desolate landscape, not far from the border with Kansas and New Mexico. Nothing special you may say.

The only major business in the hamlet is a Bitcoin mine, which changed ownership in 2021. Due to the multibillion dollar fine for Binance last month (and the conditions attached to it), the new owner recently had to identify himself.

And so, the residents of Channing have learned, to their great surprise, that the largest company in their area is owned by a 23-year-old Chinese student named Jerry Yu.

Jerry studies at NYU (New York University) and bought the company anonymously at the end of 2021, with a payment via Binance.

Money transfer was made in Tether. Due to a recent lawsuit against his Bitcoin mine and new conditions imposed by the American stock exchange watchdog on Binance, he had to identify himself.

Americans are increasingly discovering that many of the crypto mining companies on their territory are not American or even Western-owned at all, but rather investments by Chinese residents (mostly due to the ban on crypto that Chinese President Xi Jinping imposed in 2021).

ChinaImages / Depositphotos.com